FashionTech Market Memo: Rental - Part 1

An in depth analysis mapping the entire clothing rental ecosystem within FashionTech. Part 1: rental overview, rental by numbers and the major tech, social and regulatory trends shaping rental today.

Welcome to the first edition of our FashionTech Market Memo series, deep dives on the categories that make up the FashionTech world.

Today, we're diving into the clothing rental market—one of the OG FashionTech categories that never stops reinventing itself. Over the years, the space has changed A LOT, refining the business model and consumer experience to find it’s place in our closets and always make headlines (especially these past few weeks).

This is Part 1 of a 3-part series. In this first piece, we'll:

Define the category and provide stats to size up the space.

Break down the major sub-categories of rental and the key companies in each.

Explore the tech, social, and regulatory forces shaping rental.

Read until the end for a sneak peek at what’s coming in Parts 2 and 3.

Let’s get into it.

What is “Rental” in FashionTech?

Clothing rental isn’t a new concept. For generations, people have rented garments—especially formalwear like tuxedos—for special occasions. What’s changed is the how.

About 20 years ago, companies like Rent the Runway and Bag Borrow or Steal brought the rental experience online, introducing greater convenience, personalization, and access, and rewiring how we think about “ownership.”

Today, clothing rental generally refers to a digital platform (an app or website) that enables customers to rent garments for a limited period—anywhere from a day to a few months.

That’s the basic idea. But in practice, this category has evolved into several distinct models, which we’ll dive into below.

Rental by Numbers

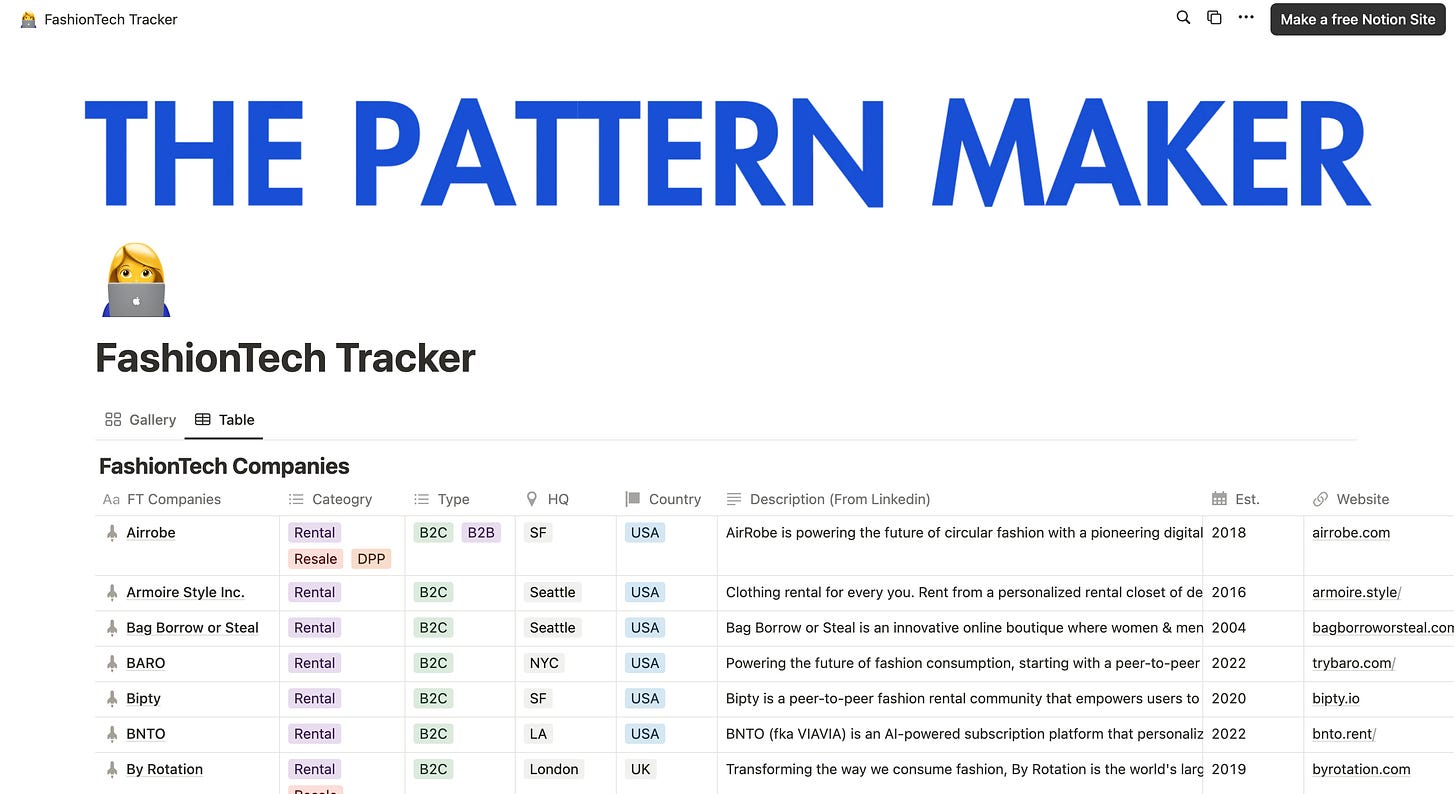

To map this space, I built a database of every North American clothing rental company I could track down…plus a handful of major European players with significant influence on the space.

You can find all the companies in The Pattern Maker FashionTech Tracker (HERE)

Here’s a snapshot of the landscape.

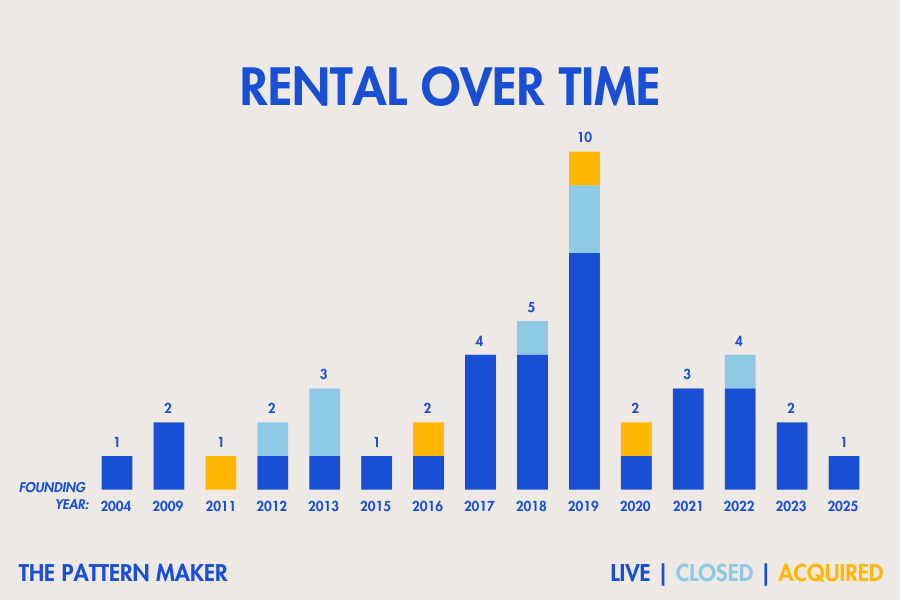

In total, this analysis covered 43 rental platforms, 32 are still operational (aka Live) and 11 who were either acquired or have since closed.

This isn’t exhaustive—there are undoubtedly more startups that have come and gone in this space (as it goes with startups). The 11 nonetheless gives us a strong sense of how the category has evolved over the last 20 years.

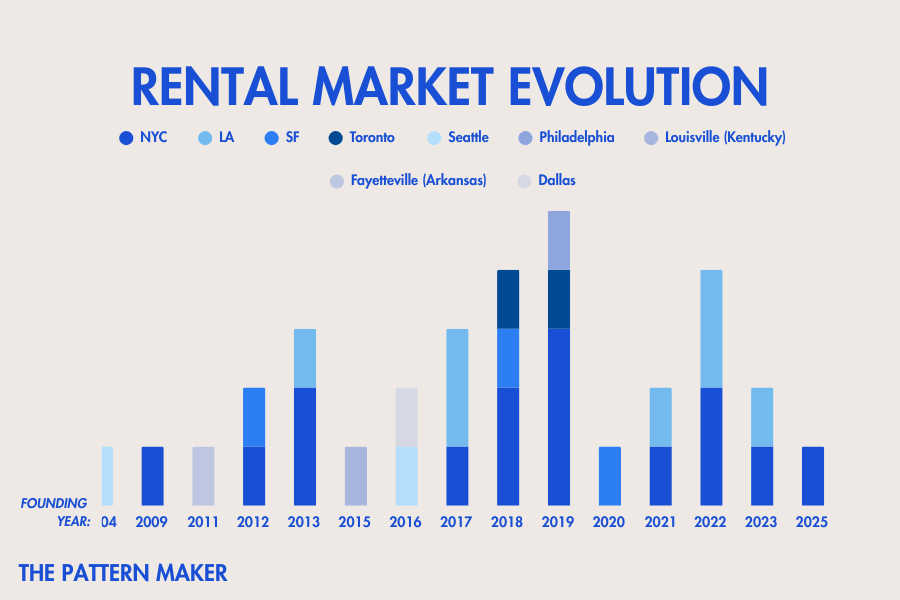

Rental companies in this dataset were founded between 2004 and 2025 with 2019 as a peak year for new entrants. Though not as strong as pre-pandemic, we can definitely say the pandemic did not kill rental - quite the contrary, rental seems stronger for it.

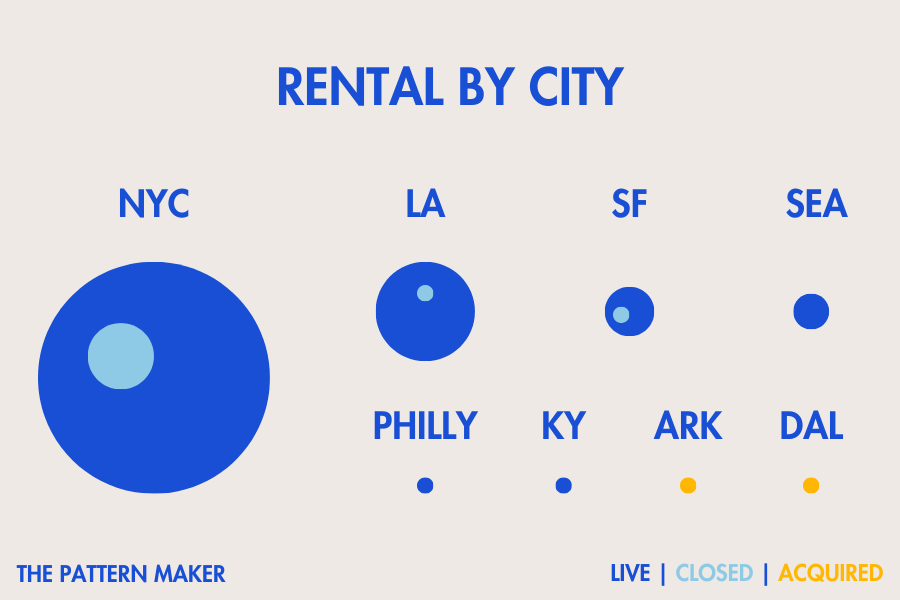

Of the 31 companies founded in the US, the majority were founded in New York City with Los Angeles and San Francisco distant second and third, respectively. More specifically, there were 15 rental startups founded/headquartered in NYC (4 have shutdown), 7 in LA (1 shutdown) and 3 in SF (1 shutdown).

In the early years, most rental startups emerged out of NYC. LA and SF followed a few years later, reflecting the usual coastal HQ trend for tech startups.

What are the major categories of Rental?

OK this is where it starts to get interesting. After analyzing the 32 North American and 10 European companies in my dataset, I believe rental generally falls into these 5 main business models.

1. The OG – Multi-brand Marketplace

These are generally the most well known players in the rental market—think Rent the Runway and Nuuly. These companies were the first to create the category and generally partner with brands or buy directly from partner brands and then manage their inventory, logistics (including dry cleaning). Some have hybrid resale strategies too.

Key features:

Inventory is company-owned or brand-managed

Much more commonly subscription based but can do one-offs

Many resell previously rented or excess inventory

May also include e-commerce alongside rental

PROS: Stronger control over brand experience, sizing consistency, and fulfillment. Subscription models help stabilize revenue and create habitual consumer behavior.

CHALLENGES: Heavy operational lift—inventory, cleaning, shipping, repairs, and returns. Capital intensive, and harder to scale profitably.

Key players in this category: Rent the Runway (IPO), Nuuly (URBN), BNTO, Isle of Monday, Wild West, AirRobe, Hauteline, FashionPass, Armoire, Gwynnie Bee (CaaStle owned), Haverdash (CaaStle owned), ModLux.Rent (powered by CaaStle)

Notable international players: My Wardrobe HQ, Threads Styling, Hirestreet, Girl Meets Dress

Acquired: Cercle, Rotaro

2. The Current Star – Peer-to-Peer (P2P)

This model lets individuals rent out their own wardrobes, similar to how Airbnb allows people to rent their homes. The platform acts as a marketplace, matching renters and lenders, but typically doesn't own or hold any inventory themselves.

Key features:

Inventory is user-supplied, not owned by the platform

Rentals are usually one-off, not subscription-based

Some platforms offer local showrooms or try-on access in their HQ city

A few offer resale features alongside rental (P2P resale)

Pick-up/drop-off often up to the users not the company - but some have logistic partners users can use.

PROS: This model solved a lot of challenges from the OG model, specifically inventory storage, logistics and merchandising. As a result this model is far more a tech solution than a logistics business. It’s also unique in its emphasis on community, starting to blend rental with social networking.

CHALLENGES: There model often struggles with consistency, especially with sizing. This increased inconsistency is a bigger barrier to overcome when acquiring new users. Additionally, common sharing economy/marketplace challenges like scaling to new markets, balancing supply and demand quickly addressing bad actors are at play here as well.

Key players in this category: Pickle, BARO, Tulerie, Bipty

Notable international players: By Rotation (UK), HURR (UK), Rites (Canada), Resuit (Europe)

Acquired: Rent My Wardrobe (2020)

3. Luxury Bags and Accessories ONLY

These companies specialize in high-end bags and accessories—think Chanel, Gucci, or Dior—offering both one-off rentals and subscriptions. This is very much positioned to be democratizing luxury for the aspirationally rich over stylish everyday fashion for the everyday girl like other rental models. As a result, many focus on creating a luxury experience, from packaging to concierge services.

** Note both Multi-brand and P2P rental companies often also offer handbags and accessories, but are not included in the list companies below

Key features:

High focus on luxury brands and statement bags over everyday bags

Inventory is company-owned and highly curated

Subscription usually only allow one item but more frequent swaps

User background checks or other vetting practices (ex. safety deposit, interview and waitlists) often required

PROS: By nature of focusing on accessories, this model does not have a sizing issues, one of the top challenges for other models. Additionally the products are generally more durable requiring less frequent repairs or replacements.

CHALLENGES: Similar issues to the multi-brand marketplace but with even higher upfront cost per item and longer payback period given luxury price point. Also higher insurance and related costs for ensuring secure shipping and storage. Additionally added cost and hurdles to customer acquisition caused by vetting process to avoid bad actors and product theft.

Key players in this category: Vivrelle, Switch, Luxe Du Jour (Luxe Bag Rental)

Notable international players: Cocoon (UK)

Acquired: N/A

4. Digital Formal Menswear

These platforms have digitized the OG rental use case —suiting up for weddings, proms, and black-tie events, layering in e-commerce and made-to-order. These models, for obvious reasons, have a major focus on perfect fit, turnaround time, and extended rental windows to allow time for adjustments as necessary.

Key features:

Menswear focused (and sometimes boys)

Specializes in suits and tuxedos only - accessories not included

More common to also offer e-commerce or made-to-order options

One-off rentals only, with longer rental windows (3-weeks) than typical (<1 week)

Strong logistics and delivery infrastructure with emphasis on speed and fit

PROS: High intent customers with highly predictable seasonal demand. More focused audience and occasion allowing for more streamlined inventory and merchandising.

CHALLENGES: Very low repeat usage, requiring highly efficient customer acquisition channels. Very seasonal demand. High competition with traditional retail options for rental.

Key players: Generation Tux, The Black Tux

Acquired: Menguin (Acquired by Generation Tux)

Shut down: N/A

Notable international: N/A

5. B2B - White Labeling

As has already been covered above, rental is a technically and logistcally challenging business model to stand up. That’s why this model was created to help brands quickly and easily setup their own rental offering with promise of creating new revenue streams and increasing the use and retail value per item. They generally provide the back-end tech, logistics, and support to help.

Key features:

Generally focused on standing up a subscription rental offering

Supplies the tech and logistics infastructure (warehousing, shipping, cleaning, repairs)

Integrates with the brands ecomm platform

Brand decides what to put on the platform

PROS: Only B2B model meaning higher value per customer and more sales focused than marketing focused customer acquisition strategy. Doesn’t manage merchandising (choosing which clothes to have on the platform, what’s cool that people want to rent). Economy of scale benefits - the logistics network and tech is already built out so low additional cost per new customer.

CHALLENGES: Success depends on brand partners executing well (marketing, good merchandising). High backend complexity and logistical dependencies. Distant from the end-user (brand’s customer). Slow sales cycles selling in to fashion brands.

Key players: CaaStle, Looks for Lease

Notable international: Lizee (France), HURR (UK – also has DTC presence)

Acquired: N/A

Tech, Social & Regulatory Shifts Driving Rental’s Evolution

It’s easy to look at the shift in rental models and think its just new founders bringing new ideas to the space. But as is always the case, there are many bigger forces under the hood shaping the evolution of rental and who will win in this space. Let’s look under the hood at the new tech advancements, shifting social values, and policy momentum around sustainability that’s moving the market.

Tech Shifts

Advanced Inventory Management: RFID tagging, digital product passports, and warehouse robotics are improving product tracking, increasing utilization rates, and enhancing margins.

Virtual Try-On Technology: Addressing the primary barrier to rental adoption by giving customers confidence in fit before committing.

AI-Powered Operations: Predictive analytics and machine learning are optimizing inventory purchasing, rotation scheduling, and dynamic pricing models.

Generative AI for Marketplaces: Reducing listing friction in P2P platforms by automating description generation and improving content quality.

Pickle is doing a lot of interesting things with AI - Read more HERE.

Social Shifts

Growing Adoption of Online Resale: Growing acceptance of secondhand has enabled success in hybrid models where rental inventory flows into resale channels, creating additional revenue streams.

Sharing Economy Normalization: Consumer comfort with access over ownership has significantly reduced customer acquisition costs over the past decade.

"No Buy" Movement: Social media trends promoting consumption reduction have positioned rental as a guilt-free alternative for fashion enthusiasts practicing intentional purchasing.

Content Culture vs. Sustainability: Despite increased environmental consciousness, social media still rewards wardrobe variety—making rental an ideal compromise between content creation needs and ethical concerns.

Rental Under Environmental Scrutiny: Growing consumer awareness about logistics emissions and chemical cleaning processes has raised legitimate questions about rental's true sustainability credentials.

Regulatory & Economic Shifts

Luxury Price Inflation: Post-pandemic price increases from luxury brands have pushed more out more consumers moving them to rental as their entry point to luxury experiences.

Tariff Impacts & Recession Concerns: New trade policies and economic uncertainty create both challenges (higher inventory costs) and opportunities (more consumers priced out of owning) for rental platforms. (”Owning?” in this economy?!?)

The Bottom Line on Rental

Let's wrap this up:

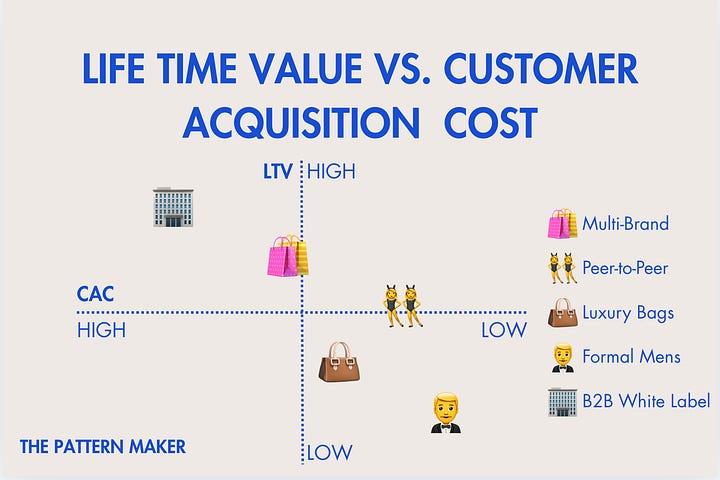

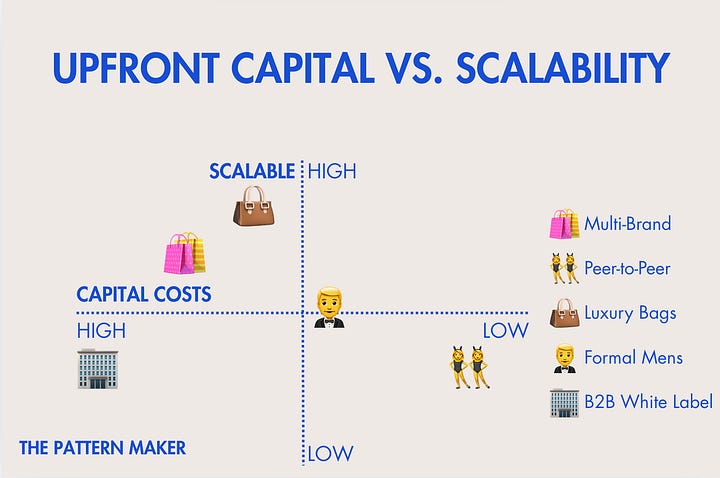

5 distinct business models have emerged in the rental space over 20 years

P2P marketplaces currently showing the most momentum post-pandemic

NYC dominates as the rental startup hub, but rentals seen success across the US and internationally

Barriers to entry are high for rental from upfront capital costs to marketplace cold start problems

Tech, social, and regulatory forces all appear largely positive for rentals continued growth

With over 2 decades of success and growth, this category has proven durable—surviving a pandemic that should have killed it — and continues to attract founder and investor interest.

Coming next in this rental series…

Part 2: For the Investor

In the next post I’ll look at the market potential including current market size and projected growth, investment activity to date in the space and what I'd be looking for in a rental company I was considering investing in.

Part 3: For the Founder

Finally, after analyzing the 40+ companies in the space, I’ll be summarizing what seems to work well, what doesn't work, where I’d focus as a founder and opportunities I'd like to see more founders explore.

Think I missed something crucial about the rental landscape? Founder or Investor in the category with other insights I should consider? Let me know—I'm building this analysis in public and value your insights. Email me at biz@rachel-sterling.com

The Pattern Maker

A++++. We're talking MBA Case Study level material that we can actually enjoy reading. Thank you for putting this together. Super interesting about the Men's formal market, which I haven't really thought of. P2P has been something that is interesting to learn about, but also if you have bad actors and they ruin the clothes is there a rating system to review the borrower? I'm not in NYC and LA atm, so haven't tried them out. But, now I think I might just download to go explore.

This was extremely good overview!! Thank you 👏