Fashion Tech Market Memo: Rental - Part 2. The Investor Perspective

Your guide to assessing the investment opportunity of fashion rental platforms from market size, growth potential, key KPIs and benchmarks to recent investment activity and big exits.

After examining the rental landscape in Part 1 of this series, This analysis dissects the market size, economics, operational benchmarks, and investment landscape to help investors understand which rental models offer the most attractive risk-reward profiles in 2025 and beyond.

Despite Rent the Runway's challenging public market performance, several rental models—particularly P2P platforms and specialized categories like formal wear and luxury accessories—show promising unit economics and paths to profitability. While logistics-heavy models require operational excellence and substantial upfront capital, the category's 7-11% CAGR and improving consumer adoption rates signal continued opportunity for well-positioned players.

Let’s get into it.

Market Size & Growth Trajectory

When it comes to market size, estimates vary significantly between research firms, generally ranging from $2-6B globally. I wasn’t able to see any significant difference in methodology or regions included in the study to determine a clear reason for this range.

For growth, global CAGR estimates cluster between 7-11% across multiple research sources. As I detailed in Part 1, I believe significant tailwinds exist from a social, technological, and regulatory standpoint which makes me believe rental still has a lot of room for opportunity in the coming years.

As might be expected, North America represents approximately 40% of the global market. More interestingly, Asia-Pacific (particularly India and China) shows the fastest growth rate for rental tech.

Within North America, rental adoption concentrates in major metropolitan areas with fashion-forward demographics. This is partly a self reinforcing trend, rental marketplaces are founded in these metros (as seen in Part 1) and it’s a marketplace best practice to commit to a tight geography when starting. But businesses that have dedicated themselves to their community outside of major metros have struggled to scale in other parts of the country (Ex. RentPonyBox in Charleston North Carolina).

From an investor perspective, these growth rates outpace traditional fashion (4-7% CAGR) but fall short of high-growth tech sectors. This suggests rental represents a moderate-growth opportunity requiring efficient capital deployment rather than a pure growth play.

Sources:

GlobalData: $6.2B in 2023, 11%+ CAGR through 2027

Grand View Research: $1.12B in 2021, 8.5% CAGR through 2030

Skyquest: $1.52B in 2023, 8.3% CAGR through 2032

Mordor Intelligence: $1.89B in 2025, 6.79% CAGR through 2030

IBIS World: $1.5B in 2024 (US only), 0.4% CAGR over past five years

Coherent Market Insights: $1.76B in 2025, projected $3.5B by 2032, 10.3% CAGR

Technavio: Growth of $1.16B from 2024-2029, 7.1% CAGR with North America contributing 51% of growth

Pricing Models & Cost Structures

Understanding the revenue and cost structures across rental models reveals significant differences in capital requirements and operational complexity. This breakdown shows why certain models reach profitability faster than others.

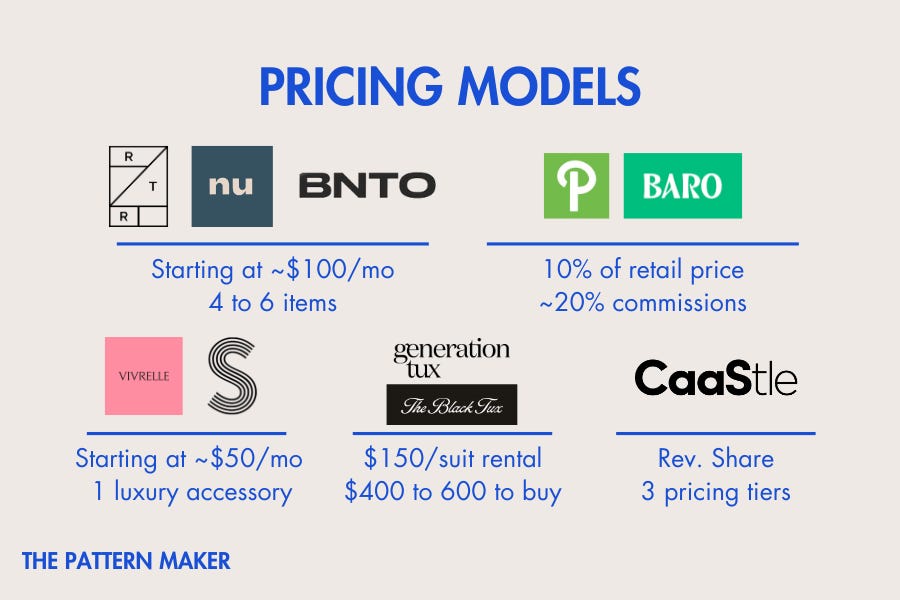

Pricing Models

Multi-brand Subscriptions

Monthly subscriptions typically start at $90-100 for 4-6 items

Examples: Nuuly: starting at $98/month, Rent the Runway: starting at $94/month, Armoire: starting at $89/month

P2P Platforms

Commission-based: typically 18-20% of rental transaction value

Items generally rent for 10-20% of retail price per rental period

Luxury Accessories

Lower price point starting around $45-55/month for a single item

Formal Wear

One-time rentals at The Black Tux and Generation Tux are approximately $150 for a full suit, $30-100 for separate pieces (2.5-week typical rental period)

Secondary revenue through purchase options ($400-600 for suits)

White Label Solutions

B2B pricing tiers based on brand size and feature requirements

Example: CaaStle charges on a per-customer basis with basic, premium, and enterprise tiers

Have you used any of these rental services? I want to hear about it!

Cost Structures

Multi-brand, Formal Wear & White Label (with logistics)

Major costs: warehouse facilities, inventory acquisition, shipping/reverse logistics, cleaning/repairs

Example: Nuuly: 300,000 sq. ft. laundry/distribution center in Pennsylvania + new 600,000 sq. ft. facility ($60M investment in 2024) handling 60% of rentals; additional $52M planned for automation (FastCompany)

Example: Rent The Runway (from 2024 10-K Report):

Fulfillment Costs = $86.0M (down 6.7% YoY)

Rental Product Depreciation and Revenue Share = $92.5M (+9.9% YoY)

G&A = $101.6M (down 6.8% YoY)

Marketing = $31.2M (down 11.1% YoY)

Technology = $49.1M (down 11.4% YoY)

Total = $378.2M (down 5.4% YoY; Revenue was $298.2M)

P2P Platforms

Asset-light model with logistics handled by lenders

Primary costs: technology, customer service, marketing

Significantly lower upfront capital requirements

Higher customer service costs due to marketplace complexity

Luxury Accessories

Similar logistics costs but with lower cleaning and repair requirements

Generally smaller items require less warehouse space

Higher costs for insurance and security during storage/shipping

Profitability Outlook

Achieving profitability is not impossible in rental tech, despite Rent The Runway's well-publicized challenges. COVID and the funding slowdown, despite collectively almost killing the category, has been good for forcing companies to focus on cost management, creating more sustainable businesses and improving the categories attractiveness.

Multi-brand Subscription

Nuuly achieved profitability in 4 years with 300,000+ active users.

Rent The Runway remains unprofitable but showing improving metrics.

P2P Platforms

This category is newer so too early to say, but lower capital requirements suggest easier path to profitability and leaders like By Rotation and Pickle seem to be on the path to profitability.

Formal Wear

The Black Tux achieved profitability in 2022, 9 years after starting (Forbes)

Generation Tux (founded by Men's Wearhouse's George Zimmer) appears profitable though reporting is limited (Forbes)

Luxury Accessories

Vivrelle: claims to have been "EBITDA profitable since inception" (PR Newswire)

White Label

CaaStle's challenges are well-documented: "In 2023, CaaStle, which raised over $500 million, generated a $90 million net loss on revenue of $15.7 million" (BoF)

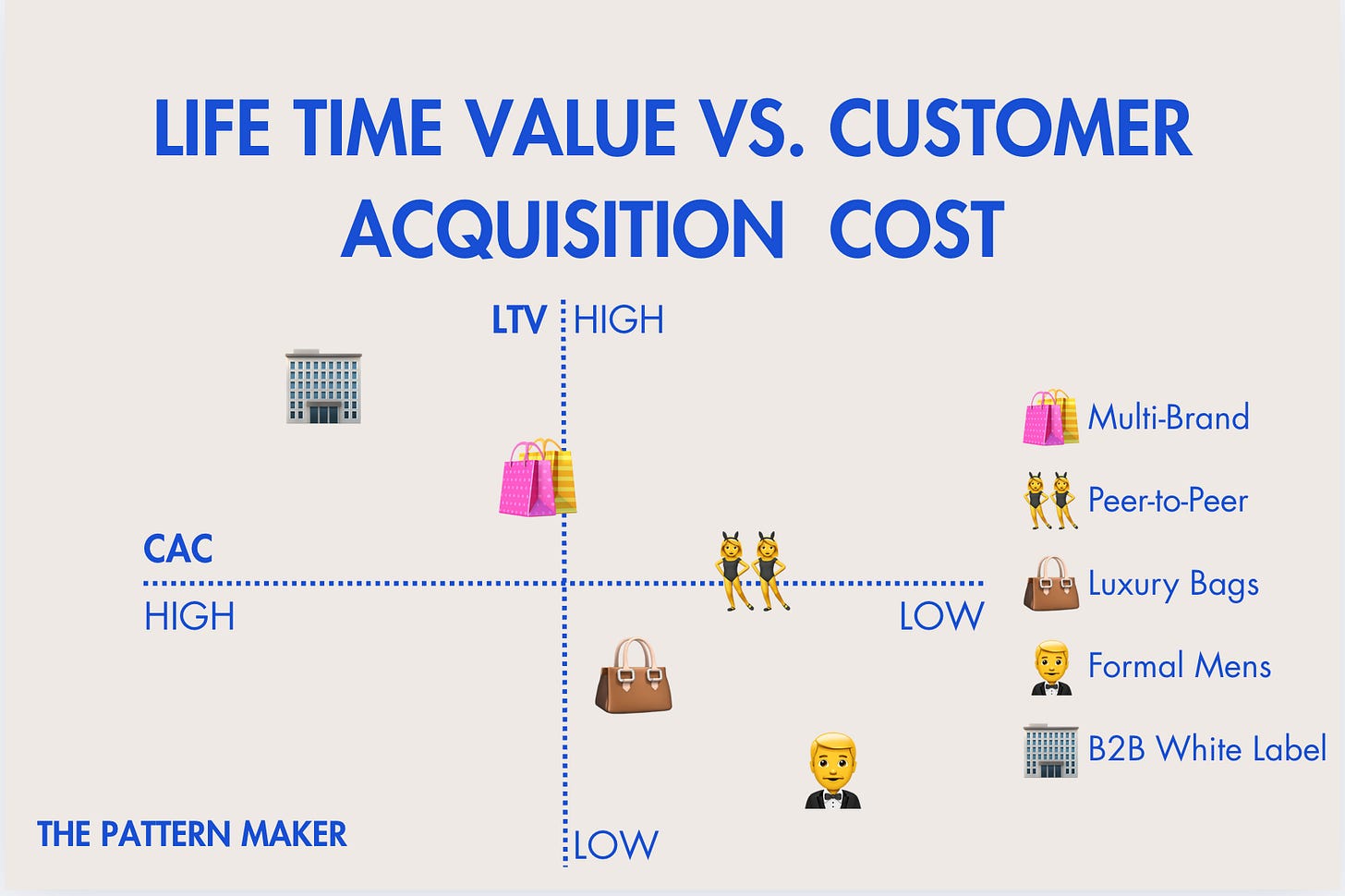

As an investor, I’d view P2P and luxury accessories models as having superior unit economics and capital efficiency, though they may face greater challenges in scaling and customer acquisition. Multi-brand subscription models can achieve profitability with sufficient scale, but require significant upfront capital and operational excellence.

Key Performance Indicators & Industry Benchmarks

All metrics and KPIs are great but here are the one’s I would focus on the most to evaluate the investment potential of a rental platform.

I’ve also done my best to dig up publicly shared industry benchmarks where possible.

I consider rental to be a fast (transactions every 3 months or less) one or two sided marketplace, so metrics and benchmarks tracked for similar models in other industries would be interesting to look at as well.

Here are the top metrics for rental…

Customer Metrics

Active users (paying subscription or rental in past 3-6 months)

Retention rates (12-month cohort analysis)

Customer acquisition costs and LTV:CAC ratio

Average order value (subscription tier) and rental frequency

Operational Metrics

Product utilization rates (rentals per item)

Inventory depreciation rates

Contribution margin to see efficiency of the inventory/merchandising

CAPEX requirements and payback periods

What metrics would you add to my list for evaluating rental platforms?

Industry Benchmarks

Active Users

Multi-brand:

Nuuly: 300,000+ active subscribers (Fast Company)

Rent The Runway: 132,574 average active subscribers (RTR)

P2P: Pickle says one in four women between 18 and 35 in Manhattan use the service (Yahoo Finance)

Formal: The Black Tux has "dressed close to 2+ million people" since 2013 (Forbes)

Accessories: Vivrelle reported an 8,000-person waitlist in 2022 (BoF)

Retention

Pickle: 90% of users still active after 12 months (WWD)

Rent The Runway: Improved retention by 8% in 2024 (actual rate undisclosed) (RTR)

Utilization Rates

High-rotation pieces: Up to 30+ rentals per item (By Rotation)

Average across categories: Approximately 10 rentals per item

Inventory & Supply

Nuuly: 400+ brands (Fast Company) and 17,000 products (Glossy, 2023)

Rent The Runway: 750+ brands (RTR)

Pickle: 2,000+ brands, 200,000 items, “hundreds of thousands of closets” (AlleyWatch)

For consumer marketplaces like rental platforms, I look for retention rates above 80% at the 12-month mark and LTV:CAC ratios of at least 3:1. Product utilization rates are the critical efficiency metric, with top performers achieving 20+ rentals per item. I also want to see efficient merchandising to ensure the company knows how to invest in inventory with a high ROI.

For other thoughts on metrics and KPIs VCs should care about for consumer/consumer tech, I recommend this in-depth post from 2023 by Taos Edmondson (dmg ventures) HERE.

Investment Activity & Exits

There’s been limited investment activity in this category for the past three years and in general, rental doesn’t seem to seek or receive much VC investment.

I believe this is due to the slow down in new rental companies being founded immediately post COVID, investor skittishness post Rent The Runway IPO flop and a shift away from VC to bootstrapping until achieving profitability in the FashionTech and specifically rental category.

I expect this activity to increase in the coming years as newer entrants founded in the last 3 years achieve product market fit and look to scale with VC.

Recent Investments (2022-2025)

Historical Investments

CaaStle raised over $530M total (last round: $43M in 2019) (TechCrunch)

Rent the Runway raised $626.1M total before IPO (last private round: $100M Series G in 2020)

Exit Activity

Rent the Runway IPO (October 2021): Priced at $21/share, opened at $23, closed at $19.29. Currently trading at $4.35 after 1-for-20 reverse split in April 2024.

M&A activity has been limited:

Menguin acquired by Generation Tux for $25M (2017)

Primarily smaller acquisitions in the $4-25M range

As an investor, I see the limited exit opportunities as a significant risk factor for backing rental. The most promising M&A exit paths appear to be strategic acquisitions by multi-brand retailers and conglomerates or larger established rental or resale platforms looking to expand their rental capabilities. Otherwise, I’d assume the goal is to IPO with better results than Rent The Runway saw.

The Investor's Lens: My Criteria for Rental Investments

Beyond the quantitative metrics, these are the qualitative factors I’m looking for - from team background to how the founders are thinking about their company - when evaluating rental startups:

What’s the teams unique insight into how to attract new customers? Most consumers are still new to rental so it’s not about your share of the pie, it’s about educating consumers to grow the pie.

Full Time Ops expert from a logistics heavy company. I would want to see someone full time on the team with a highly relevant prior ops experience from a company like Amazon, Uber, Rent The Runway, etc.

Clear ICP and style niche + unique sourcing strategy. I would want to see A LOT of clarity on who their customer is, what’s their style aesthetic and what brands or lenders match that aesthetic. They then should know how they’re ensuring they’re consistently sourcing the best merchandise at the best price/rev share model - the reject products from the hottest new designer still won’t win.

B2B sales and merchandising experts from fashion (esp. for White Label). For all models, I’d love to see someone on the team or an advisor/investor who has the fashion relationships to secure major partnerships. This is a non-negotiable for white label models. I also want to see merchandising/fashion planning expertise (i.e. they know what clothes/styles to source, in what quantities, etc.) to improve product utilization.

QA and repairs management strategy. How are they efficiently QAing products (and eliminating bad actors for P2P)? How do they manage repairs cost effectively? This is “make or break” for customer satisfaction and managing costs.

Use of Tech and tech talent. The founders should be able to clearly articulate what advanced tech they’re already using or building to achieve operational efficiency and improve customer/lender experience. They should have a GREAT answer of how AI will be integrated into their platform and when. I’d want to see a full time founder or early employee with developer or technical product management experience from a big tech or high tech startup.

Final Thoughts: Where I'd Place My Bets

Looking ahead, I'm most excited about:

P2P platforms with tech that makes listing and making money as a lender super simple to improve quality of products on the platform and incentive for lenders.

Specialized category players who nail merchandising and have a unique sourcing advantage focusing on high utilization rate and low variability

The most promising investment opportunities will likely come from companies that can:

Maintain strong retention while reducing CAC (duh…)

Achieve product utilization rates well above industry averages

Create defensible network effects

Build toward profitable unit economics from day one

For founders and investors interested in discussing the rental space further, I'd love to connect. The category still has significant untapped potential despite its challenges, particularly for teams who approach it with capital efficiency and operational excellence.

Which rental model would you invest in?

This analysis is part of my ongoing Market Memo series on fashion tech categories. Read Part 1 of the Rental series for a broader overview of business models, major players and market trends. Next up: Part 3 - The Founder's Perspective: how to build and win in this category.

The Pattern Maker

A word to my paid subscribers!

Thank you so much to those who’ve already pledge to support my work. I’m committed to putting in the time to ensure this content is in-depth and does the heavy lifting a lot don’t have the time to do to help support the growth of fashion tech. Knowing this work is valuable and something you’d want to support means the world! Thank you 💙

i love this, thanks for sharing!